Frequently Asked Questions

IS ONE STOP THE RIGHT STOP FOR ME?

We believe in trust, open communication and transparency. We believe in simple solutions, proactive problem solving and customized programs that fit within every client’s budget.

Here are some questions that you should be asking every Accounting Firm that you interview to earn your trust:

- Who exactly is working on my tax return?

- Are your staff licensed?

- How many people work in your firm?

- What are your fees and are there any hidden costs? Do you charge by the hour?

- Can I call and ask a quick question at any time?

- Is my data safe? What measures do you take to protect my identity?

- Do you keep current on changes to tax laws and court cases that affect tax rules?

- Do you remind me of deadlines and provide other educational opportunities?

- Can I trust you? Am I comfortable talking to you? Do I feel important?

WHAT ARE THE FEES? CAN I AFFORD AN ACCOUNTANT/BOOKKEEPER?

All fees are flat-rate prices except for QuickBooks training which is charged by how many hours you need. Bookkeeping and Payroll are flat monthly rates based on your company’s revenue and start at just $50 per month. Tax Preparation fees are a one-time flat-rate fee depending on the complexity of your tax return. Never let a tax professional charge you for a tax return based on how much your refund is – that is illegal!

WHAT IS THE BEST WAY TO COMMUNICATE WITH ONE STOP?

Our primary form of communication is email. It allows us to document, follow up and reference our work and the conversations we have. For a quick question or to schedule an appointment, you may text Ivy Fivey directly to 305-389-3804. To leave a voicemail, call our Voicemail System at 407-922-0918. All calls are returned within 24 hours or the next business day.

CAN I USE ONE STOP FOR ONLY ONE SERVICE AND NOT ALL SERVICES OFFERED?

Yes! We offer payroll, bookkeeping, and QuickBooks Help, in addition to Tax Preparation. If you want to use another Tax Professional to prepare your taxes, we will work with them to ensure a smooth and seamless tax season.

QUICKBOOKS ONLINE OR DESKTOP?

QuickBooks for Desktop is used by One Stop Consulting Shop for clients who do not handle or participate in their own bookkeeping. We send these clients a monthly report for their review between the 15th and 25th (depending on the client) or any agreed upon date after the 5th and we handle all data entry, changes and corrections.

QuickBooks Online is a better option for clients that want to handle their invoicing themselves, use 3rd party software integration but prefer for One Stop Consulting Shop to reconcile their accounts and handle other tasks as well as review the books on a monthly basis. QuickBooks Online can also be accessed by multiple people from any computer via a web browser. QBO has a monthly fee (and can be purchased through One Stop Consulting Shop for a discounted rate).

Both options allow for a seamless tax preparation experience!

IS MY INFORMATION AND DATA SAFE?

We use a Client Portal powered by Citrix ShareFile. This software is used by 99% of Fortune 500 Companies. It uses 256 bit SSL encryption for data in transit and 128-bit RC4 encryption for data at rest, while saved. We also use encrypted email for the fast sending of information and provide every client with a unique log-in and password. We use enterprises level security and next gen firewalls operated by our in-house Chief Technology Officer who has over 20 years of experience in data security and storage solutions.

CAN I SIT WITH THE INDIVIDUAL DOING MY TAXES?

At One Stop, we work with clients across the Country because we operate as a virtual firm. Because of this, we have the ability to select the very best licensed and credentialed Tax Professionals from other areas so that location is not the basis for our decision. When we prepare your return, only the licensed Tax Professional signing the return enters your data. Many firms use interns, non-credentialed staff and seasonal help to enter your data with the Tax Professional only reviewing the final product. At One Stop, each of our Tax Professionals complete your return from start to finish independently and thoroughly. By having one person complete the return from start to finish, this reduces the potential for errors.

Should you need to speak with our Tax Professionals directly, we will schedule a conference Teams or Zoom meeting with you throughout the process as we work as a team with every client. Our Tax Professionals are always available for conversations! If you are located in the area of one of our Tax Professionals, we can schedule an in-person appointment as well!

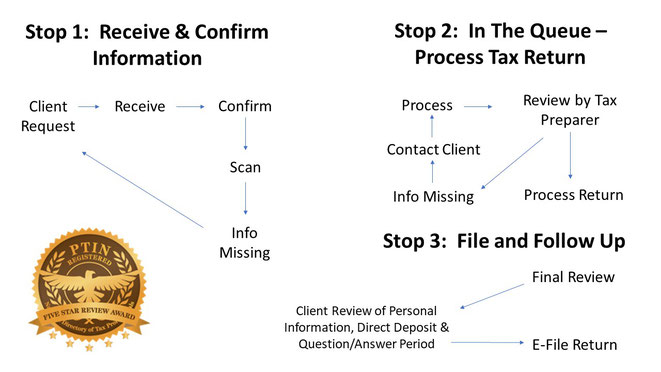

THE TAX RETURN PROCESS EXPLAINED

Choosing the right Tax Professional is not easy and the client/advisor relationship has to be a good fit on both sides to be successful! Not everyone prepares a tax return in the same way so we feel it is important to educate our prospective clients with the “WHY” behind our process and the importance of choosing a licensed and experienced tax advisor. When done correctly, a tax return should be the same regardless of where you go or who prepares it. However, there exists a large gap in the tax community regarding estimates, review of documentation, and the difference between 1) working to ensure as close to an audit-proof return as possible versus 2) preparing a return and “hoping you do not get audited”.

We believe communication should be clear and concise so we outline our working conditions and are continually improving our own process flow. Our goal is to ensure we use our knowledge and years of experience to find you every potential deduction and credit within the law to reduce your tax liability. However, we also take measures to ensure we provide an accurate return that is as “audit-proof” as possible. Where other firms may accept estimates or whatever numbers are provided, we require back-up documentation to help you, our client, be protected in the case of an audit and ensure you are in the best shape possible. We also use an encrypted portal to ensure the transfer of information is secure, safe while also convenient for our out-of-area clients. Finally, we take our time with our tax returns, continually review the information to ensure everything is accounted for, and that our system accurately computed the data we entered. We don’t trust the software; it is a tool that we then double check to ensure accuracy and integrity of the process. Sometimes this is not a fast process and a return can take weeks to complete depending on how complete the initial receipt of information is and depending on how many questions arise during the review process. We always strive to complete tax returns as quickly as possible, but without “rushing” the process as we never want to sacrifice quality for speed.

Anyone with a PTIN number can prepare a tax return. So it is important to know the type of license and experience your Tax Preparer holds. The rules change frequently and court cases update how deductions and credits may be treated from year to year. This is why we employ Enrolled Agents, who are federally licensed with the IRS and focus solely on tax planning and tax preparation. They stay up to date on the constantly changing laws to ensure your deduction is not just beneficial, but correct! We also have recently hired a Florida licensed CPA to balance our team and each of our tax preparers adds their own individual expertise and experience to our One Stop family!

BACK-UP DOCUMENTATION:

You may be asked to show back-up documentation to substantiate deductions and credits and these requests may include, but not be limited to, mileage logs, receipts, bank statements, adoption papers, and any other document required to ensure an accurate and complete tax return.

For mileage logs, you must maintain a written log (or if using an “App” the same requirements apply for the report that you will print) that includes documentation identifying the vehicle and proving ownership or a lease and a daily log showing miles traveled, destination and business purpose.

For charitable donations, any cash donation over $250 requires a written letter from the organization and any “good” donated requires a receipt with the amount (value) and what the donation is written on the receipt. If I have substantial donations, it is your responsibility to ask One Stop at the time how to properly document these donations so they can be deductible.

SOME THINGS TO REMEMBER:

Tax Preparation is a dynamic process that requires on-going communication and dialogue. It’s our mission to guide you smoothly through the process to ensure accuracy, understanding and compliance. We do not prepare “same-day” returns as we believe more time is required for thorough review and completion.

Some things to remember about the process:

- It is the client’s responsibility to provide all back up documentation and information so we can accurately prepare the tax return.

- It is the client’s responsibility to review the return and sign/return the form 8879 (by uploading it to the client portal) that allows your return to be e-filed. Your return is not considered “filed” until that 8879 form is received and processed.

- If your return is not e-filed, it is the client’s own responsibility to mail the return to the IRS and the appropriate State authority.

- It is important to understand that a Tax Return Extension (of time) is NOT an extension for payment. Clients should pay any tax due by the 15th of the 4th month following your tax year-end (for individual returns) or penalties and interest may accrue.

- Tax Planning and responding to IRS and/or State Notices that are not a direct result of any action taken by One Stop Consulting Shop, LLC, are above and beyond the scope of preparing your tax return and may require an additional fee for questions, research and written responses to IRS correspondence.

We welcome new clients and look forward to helping Families, Sole Proprietors, S-Corps and Start-Ups ensure compliance and peace of mind while reducing your tax liability! If you are interested in a FREE consultation, please contact us today.